As cross-chain solutions grow more popular, bridging your assets can unlock exciting DeFi opportunities—but it also introduces hidden fees and security concerns.

Below, we’ll show you how to move crypto safely between blockchains while keeping costs to a minimum.

Understanding Cross-Chain Bridging with Rhino.fi

Blockchains are designed as isolated islands, each with its unique rules and code. While this robustness adds security, it also isolates these islands, making it challenging for them to communicate. If you hold assets on one blockchain, you’re free to explore, exchange, and engage within that ecosystem. However, transferring tokens between different blockchains isn’t straightforward.

In the traditional fiat world, swapping currencies between different lands is a breeze. The crypto world should be no different. That’s where bridges come into play. Bridges act as intermediaries, bridging the rules and code of two distinct blockchains, enabling data and value to flow seamlessly.

How Bridges Are Categorized: Transfer types and Trust Assumptions

Bridges can be categorised by both transfer type (simple to complex), and trust assumptions (strong to weak). Let’s deal with transfer types first.

There are five types of bridges, although the design space is large and the lines are blurred. The five main types of bridges, according to transfer type, are:

- Lock & Mint e.g. Polygon official bridge, StarkNet official bridge, Shuttle.

- Token Issuer Burn & Mint e.g. MakerDao, Arbitrum Teleport.

- Specialised Burn & Mint e.g. Hop, Debridge.

- Atomic Swap e.g. Stargate.

- Third Party Networks/Chains e.g. Thorchain

In addition to various token transfer methods, considering trust assumptions is crucial. Each bridge falls on a spectrum from strong trustworthiness (not ideal) to weak trustworthiness (preferred). Trust levels can be categorized as follows:

- Centralized Bridges e.g. the Binance-to-Arbitrum bridge.

- Validator/Multi-Sig Bridges e.g. Wormhole, Axelar, and Connext.

- State Proof Bridges e.g. StarkEx to Ethereum, ZKSync to Ethereum, Nomad, Hop, Axelar, and Mina.

- Protocol-Level Bridges e.g. Cosmos IBC.

How does the Rhino.fi Bridge Work?

Rhino.fi operates a system based on collateralized bridges and liquidity outposts—token pools strategically positioned across various chains, backed by us.

The driving force behind this process? Smart contracts.

Users supply rhino.fi with assets on one chain, and through smart contracts and StarkEx technology, rhino.fi provides corresponding assets from our pool on another chain.

The benefits of this method lies in its adaptability, enabling seamless onboarding for new chains. In essence, we can bring you the hottest chains as soon as they launch. It also ensures a seamless user experience with one-click bridging and nearly instant transactions—deposits within minutes, withdrawals within seconds.

How to Use the Rhino.fi Bridge

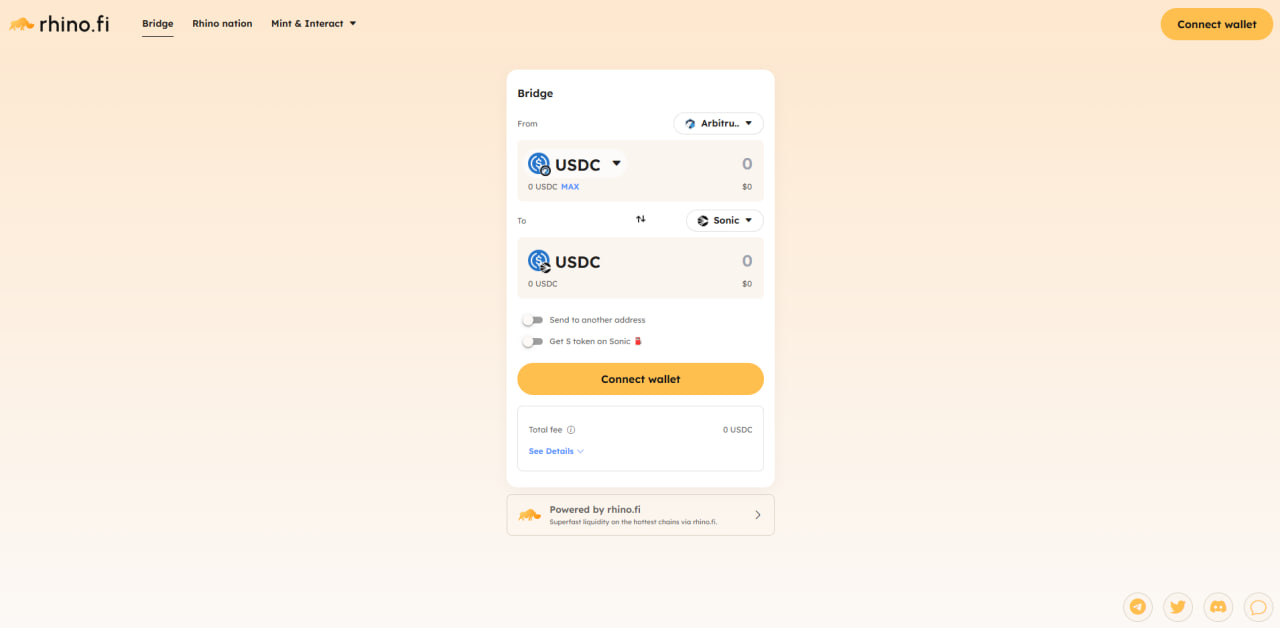

Step 1: Navigate to our website here: https://rhino-fi.com

When entering the app for the first time, you will see a ‘connect wallet’ button in the middle as well as the top right hand corner. Click on the image to go perform bridging.

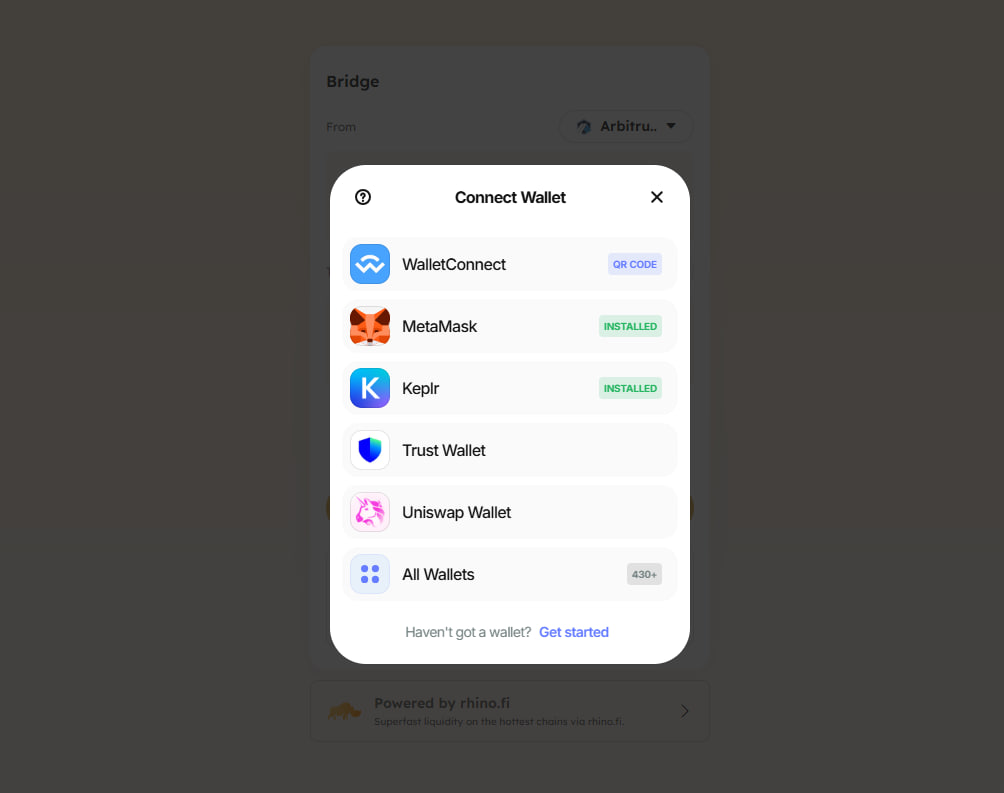

After clicking ‘connect wallet’ you will have the option to select from a range of wallet types. Choose your wallet, and follow the steps to connect.

The connection method varies for each type of wallet. For example, to connect a MetaMask wallet to rhino.fi, users need to access the MetaMask wallet via their browser (or download the software if they haven’t already).

Step 2: Bridging

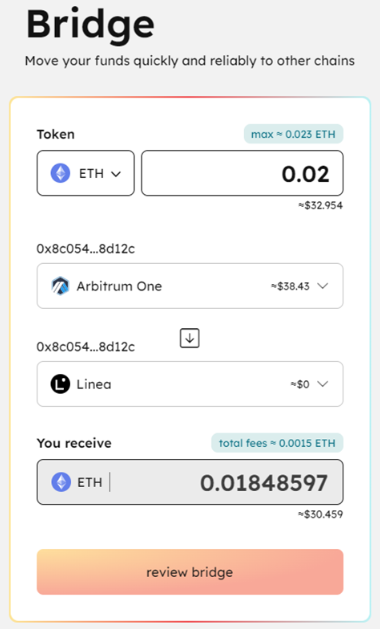

When you’re ready to bridge, from the bridge screen, select the token you wish to bridge, as well as your output and destination chain.

Input the amount you want to bridge, and this will automatically generate the amount that will be received on the destination chain less fees.

Is the Rhino.fi Bridge Safe?

Our bridge is authorised, which means that only rhino.fi can issue withdrawals to our bridges. Also, we use our own funds as collateral. In the brief history of DeFi, cross-chain bridges have suffered a small number of security exploits. But even if this were to happen on rhino.fi (and, as we’ll mention below, we’ve put robust measures in place against this), the liquidity would come from rhino.fi, not our users.

Self-custody is crucial to rhino.fi. Unlike centralised crypto exchanges, we allow you to keep full control of your funds, and our system of smart contracts and user signatures is fundamental to this.

Nonetheless, there is a small trusted element in the bridging process. As mentioned, our users give rhino.fi assets on their origin chain and rhino.fi provides their desired assets on their destination chain. In other words, the user gives us tokens and trusts that we will give them tokens on another chain.

This trusted element is necessary to ensure speed: if the process were totally trustless, it could take as much as 20 minutes to move from one side of the bridge to the other.

Summary

In summary, cross-chain bridging with rhino.fi opens doors to diverse blockchain opportunities. We’ve covered the basics, explained how our bridge operates, touched on fees, and discussed security. Now, you’re equipped to navigate the world of DeFi with rhino.fi’s cutting-edge bridging solutions.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.